The National Rating Agency presents a study of the gold mining industry in Russia in 2020. The article examines aspects such as investment demand, financial results of Russian gold mining companies, as well as the state of the global gold supply amid restrictions due to measures to counter the spread of COVID-19. NRA experts note that the average annual gold price in 2020 will grow by more than 20%. Against the backdrop of rising prices, the financial results of Russian gold mining companies will improve: revenues in 2020 may increase by more than 30% on average, and the EBITDA by 48%.

Roscongress Foundation analysts highlighted the main theses of this research, accompanying each of them with suitable fragments of video broadcasts of panel discussions held as part of business programs of the key events hosted by the Foundation.

Gold is one of the traditional defensive assets in times of economic uncertainty. The COVID-19 pandemic was no exception and had an impact on investor demand, which increased in Q1 2020. However, due to the restrictions caused by the pandemic, global gold extraction decreased by 3% compared to Q1 2019.

By the summer of this year, the price of gold reached its maximum since 2012, having increased by 14% amid falling prices for other assets (for example, the Dow Jones Industrial Average fell by 12% during this time). Large-scale financial assistance programs adopted in the largest economies of the world increase inflationary risks, the tool for reducing which traditionally becomes gold.

In 2019, investor demand accounted for almost 30% of the global demand for gold, while in Q1 2020, the share of investors in the demand structure reached 50%. In the Q1 2020, demand from investors increased by 80% year-on-year and almost doubled compared to the previous quarter, while demand in other segments decreased.

In general, global demand for gold in Q1 2020 increased by 1% in annual terms and by 3% compared to the previous quarter. However, the global gold supply is declining amid restrictions due to measures to counter the spread of COVID-19, which have caused disruptions to gold extraction and supply chains. Global gold extraction decreased by 3% compared to Q1 2019 and by 12% compared to Q4 2019. Gold supply decreased by 4% in annual terms and by 13% quarter-on-quarter

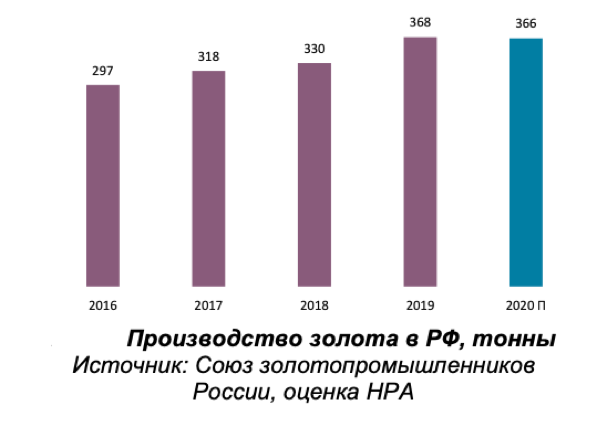

As of 2019, Russia is the third largest gold producer in the world, behind only China and Australia. In the Q1 2020, gold production increased by another 5%, but in April, due to the negative factors of the coronavirus pandemic, the bullion production decreased by 23% year-on-year.

In 2019, due to the development of mining assets and the processing of refractory concentrates, domestic producers set a record for gold production 368 tons, which allowed the country to occupy about 11% of the world market. Russia is the third largest gold producer in the world, behind only China and Australia.

In the Q1 2020, gold production increased by 5% to 64.6 tons. Russian producers felt the impact of COVID-19 in April: the bullion production decreased by 23% year-on-year. Given the expected decline in the Russian economy by 5-6% in 2020 and inflation by 4-6%, gold production this year may remain at the level of 2019.

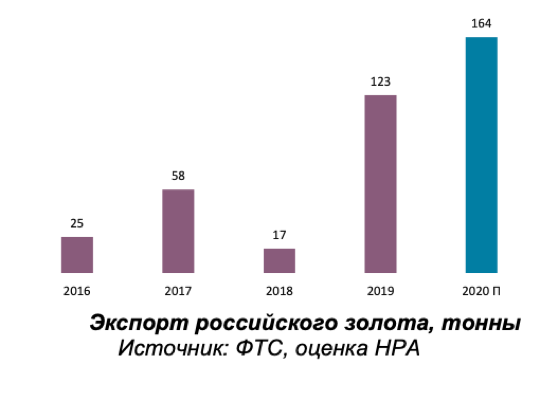

Against the background of record extraction figures and an increase in global investment demand, gold exports in 2019 increased sevenfold, reaching a third of production. At the end of JanuaryApril 2020, exports increased 7.5 times compared to the same period last year, while in April volumes showed a 13-fold increase. More than 90% of supplies go to the UK: London is a gold trading center. Gold imports to Russia are insignificant and comparable to less than 1% of exports. In 2020, against the background of a decrease in world extraction, Russian gold exports may grow by a third, to 164 tons.

Gold mining in the Russian Federation is characterized by a fairly low market concentration, close to the average. The value of the Herfindahl-Hirschman index is about 800 units, the concentration coefficient for the first eight players is 56%. In Q1 2020 among public companies only Polyus and Highland Gold Mining (Russdragmet) cut production.

See other materials posted in special sections of the Rosсongress Information and Analytical System StayHomeEconomy, Investment Projects, Exploration and Production, Monetary Policy and Financial Market dedicated to the sphere of precious metals extraction and support of investment projects, as well as possible ways to stabilise the economy in conditions of a pandemic.